Compliance isn’t cheap, but it also isn’t something you can afford to ignore. Whether you’re prepping for ISO 27001, CMMC, or GDPR audits, gap analysis is where the real work often begins. It’s that first honest look in the mirror, where your internal policies and controls meet actual regulatory expectations. The price tag? That depends on how deep you want to go, what shape you’re starting from, and whether you’re building your path with consultants, in-house talent, or automation.

This article breaks down the real-world cost of compliance gap analysis, not just the invoice from your auditor, but the surrounding work that usually eats the bulk of the budget. If you’re planning ahead or trying to avoid six-figure surprises down the line, this guide will help you understand where the money actually goes and what to expect.

What Is Compliance Gap Analysis and What Does It Cost on Average?

Compliance gap analysis is the process of comparing how your organization currently operates against what regulations, standards, or internal policies require. It answers a simple but uncomfortable question: where are we falling short, and how serious are those gaps?

From a cost perspective, a compliance gap analysis usually ranges from $3,000 to $25,000 for smaller organizations, and can exceed $50,000 or more for larger or regulated environments. That number alone rarely tells the full story. The real cost often includes preparation work, remediation planning, staff time, documentation updates, and follow-up assessments.

For some teams, gap analysis is a short diagnostic exercise. For others, it becomes a recommended first step when preparing for frameworks like ISO 27001, HIPAA, GDPR, or CMMC. The difference between those two scenarios is what drives the cost.

How We See Compliance Gap Analysis From an Engineering Perspective

Au Logiciel de liste A, we usually get involved in compliance conversations from the technical side, not as auditors. Teams come to us when a gap analysis has already surfaced real issues – unclear access controls, missing logs, legacy systems that were never designed with compliance in mind. In those moments, the cost of gap analysis stops being an abstract number and becomes a practical question of engineering effort, system changes, and time. From our side, we see that the biggest cost drivers are rarely the findings themselves, but how deeply compliance requirements cut into existing architecture and workflows.

We work with companies that operate in regulated environments, from finance and healthcare to manufacturing and professional services. What this has taught us is that gap analysis costs rise sharply when systems are fragmented or documentation does not reflect reality. When teams rely on outdated infrastructure or loosely managed access, every compliance gap translates into additional development, refactoring, and testing work. That is where organizations often underestimate the total cost – the gap analysis reveals issues that require real engineering hours to fix, not just policy updates.

From our experience, the most cost-effective compliance journeys are the ones where technical teams are involved early, right after the gap analysis stage. When remediation planning aligns with how systems are actually built and maintained, organizations avoid rework and rushed fixes later. We see compliance gap analysis as a diagnostic step that should inform technical decisions, not sit in a report. Done right, it helps teams prioritize what truly matters, control long-term costs, and build systems that are easier to audit the next time around.

Typical Cost Breakdown of a Compliance Gap Analysis

Compliance gap analysis costs often fall into several broad categories, though the actual structure may vary depending on the framework and organizational needs.

Initial Gap Assessment

This is the core analysis itself. It includes reviewing policies, interviewing stakeholders, evaluating controls, and mapping current practices against requirements.

Typical cost ranges:

- Small organizations: $3,000 to $8,000

- Mid-sized organizations: $8,000 to $20,000

- Large or regulated environments: $20,000 to $50,000+

This stage often produces a compliance matrix or findings report that labels controls as compliant, partially compliant, or non-compliant.

Documentation Review and Evidence Collection

Organizations with outdated or inconsistent documentation tend to pay more here. Missing policies, incomplete logs, or unclear ownership increase effort and cost.

Costs usually appear as:

- Additional consulting hours.

- Internal staff time spent rewriting policies.

- Delays that push the analysis into multiple phases.

In practice, documentation work often adds 20 to 40 percent to the base assessment cost.

Remediation Planning

A proper gap analysis does not stop at listing problems. It outlines how to fix them.

This includes prioritizing gaps by risk, estimating remediation effort, and assigning ownership and timelines.

Remediation planning is often bundled with the analysis, but in more complex environments it becomes a separate cost ranging from $5,000 to $15,000 depending on depth.

Internal Staff Time and Opportunity Cost

This cost is rarely listed on invoices, but it is real. Compliance gap analysis requires time from IT, security, legal, HR, and leadership.

Common internal cost drivers:

- Interviews and workshops.

- Evidence gathering.

- Policy reviews and approvals.

- Meetings to align on findings.

For many organizations, internal time investment equals or exceeds the external assessment cost.

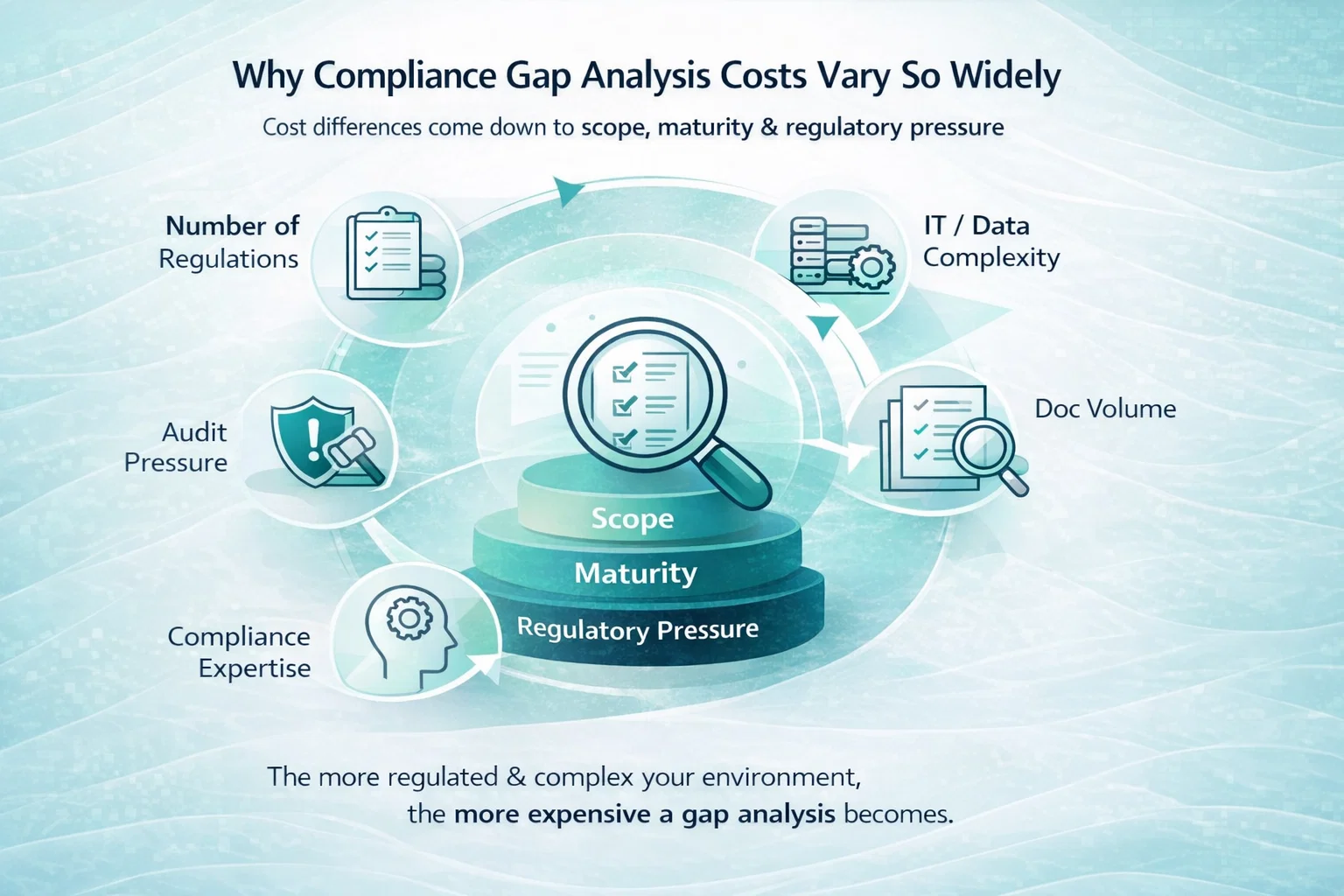

Why Compliance Gap Analysis Costs Vary So Widely

There is no fixed price for compliance gap analysis because no two organizations start from the same place. Cost differences usually come down to scope, maturity, and regulatory pressure.

A small SaaS company reviewing internal policies against GDPR will face a very different bill than a defense contractor aligning with NIST 800-171 or CMMC requirements. The analysis itself may look similar on paper, but the depth, evidence required, and risk exposure are not.

Several factors consistently influence pricing:

- Number of applicable regulations or standards.

- Complexity of IT and data environments.

- Volume of documentation to review.

- Availability of internal compliance knowledge.

- Industry enforcement risk and audit exposure.

The more regulated your environment, the more expensive a proper gap analysis becomes. Not because assessors charge more by default, but because accuracy matters more and mistakes cost more later.

How Regulatory Frameworks Influence Cost

The framework you are assessing against has a direct impact on cost. Some standards are broader and more flexible, while others are highly prescriptive.

ISO 27001

ISO 27001 gap analysis focuses on governance, risk management, and information security controls. Costs are moderate but increase if organizations lack an existing ISMS.

Typical gap analysis cost: from $2,000 to $10,000+ depending on scope and organization size.

The cost increases when organizations attempt to align ISO 27001 with other frameworks at the same time.

GDPR and Data Privacy Regulations

Privacy-focused gap analysis often spans legal, technical, and operational domains. Typical review areas include data mapping, consent handling, access controls, and retention policies. Unlike audit-driven standards, GDPR assessments vary widely depending on the scope and complexity of personal data processing.

Typical gap analysis cost: $3,500 to $20,000+

Organizations that handle large volumes of sensitive data or operate across multiple jurisdictions usually fall at the higher end of the range.

HIPAA

HIPAA gap analysis requires structured review of administrative, technical, and physical safeguards that protect health information. This includes role-based access, audit logging, breach procedures, and third-party agreements.

Typical gap analysis cost: $8,000 to $25,000

Smaller practices with well-managed systems may fall at the lower end, while large or complex healthcare environments often exceed $20,000 due to integration challenges and legacy infrastructure.

CMMC and NIST-Based Frameworks

Gap assessments for CMMC and related NIST frameworks (such as NIST 800-171) involve rigorous control mapping, evidence review, and readiness validation. These assessments are typically the first step before costly remediation and formal certification.

Typical gap assessment cost: $3,500 to $20,000

Full compliance costs (including remediation, tooling, and assessments): $100,000 to $200,000+

Many organizations mistakenly equate the gap analysis with the total CMMC budget. In practice, assessment is just the beginning – documentation, control implementation, and managed environments (like CUI enclaves) drive the larger spend.

Why Gap Analysis Is Often Cheaper Than Fixing Mistakes Later

One of the clearest patterns across compliance programs is this: skipping or rushing gap analysis almost always increases total cost.

Common downstream consequences:

- Failed audits.

- Emergency remediation under time pressure.

- Premium consulting rates.

- Lost contracts or regulatory penalties.

Gap analysis acts as cost control, not just compliance theater. It allows organizations to fix problems on their own timeline instead of reacting under enforcement pressure.

Hidden Costs Organizations Rarely Budget For

Even experienced teams tend to overlook certain expenses when planning gap analysis.

Scope Misjudgment

Underestimating how much data, systems, or processes fall under compliance leads to rework. Overestimating leads to overspending.

Both scenarios increase total cost.

Manual Evidence Collection

Spreadsheet-driven compliance work looks cheap at first. Over time, it becomes expensive due to errors, duplication, and audit friction.

Manual work inflates staff time costs and increases risk of missed gaps.

Training and Awareness Gaps

If employees do not understand compliance requirements, gap analysis findings repeat themselves year after year. Fixing the same issues repeatedly costs more than addressing root causes early.

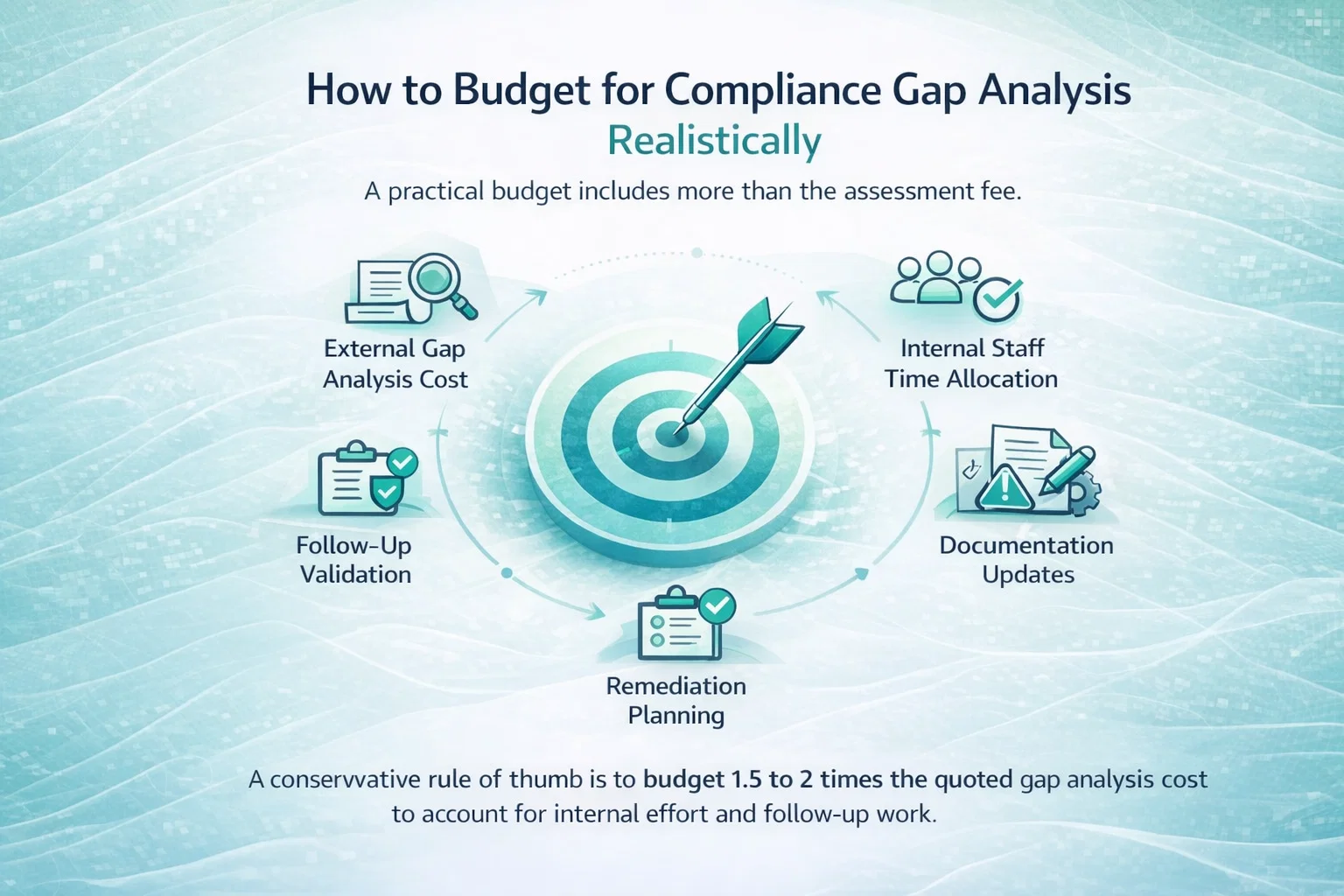

How to Budget for Compliance Gap Analysis Realistically

A practical budget includes more than the assessment fee.

At minimum, organizations should plan for:

- External gap analysis cost.

- Internal staff time allocation.

- Documentation updates.

- Remediation planning.

- Follow-up validation.

A conservative rule of thumb is to budget 1.5 to 2 times the quoted gap analysis cost to account for internal effort and follow-up work.

When Gap Analysis Becomes an Ongoing Cost

For regulated industries, compliance gap analysis is not a one-time event. Regulations evolve, systems change, and new risks emerge.

Organizations subject to regular audits often run annual light gap reviews and full gap analysis every 2 to 3 years.

Ongoing gap analysis costs are usually lower per cycle but add up over time. Planning for this avoids budget shocks.

Is Compliance Gap Analysis Worth the Cost?

From a pure cost perspective, gap analysis is one of the least expensive parts of a compliance program. Remediation, tooling, audits, and enforcement failures are far more expensive.

Organizations that treat gap analysis as a strategic exercise rather than a checkbox typically see:

- Fewer audit surprises.

- Lower long-term compliance costs.

- Better internal accountability.

- Faster certification timelines.

The value is not in the report itself, but in the clarity it brings.

Réflexions finales

Compliance gap analysis costs vary widely because compliance itself varies widely. What stays consistent is the role gap analysis plays in controlling risk and spending.

The organizations that struggle most with compliance are rarely the ones that paid too much for gap analysis. They are the ones that skipped it, rushed it, or treated it as paperwork instead of decision support.

If compliance is part of your business reality, gap analysis is not optional. The only real decision is whether you pay for it early, deliberately, and on your own terms, or later under pressure when costs are higher and options are limited.

In most cases, the cheaper path is also the smarter one.

FAQ

- Is a compliance gap analysis really necessary, or can we go straight to audit?

You can skip it, but you probably shouldn’t. Going straight into an audit without a gap analysis is like showing up to an exam without knowing what’s on the test. The analysis helps you find weak spots before they become expensive problems. If your systems or policies haven’t been reviewed in a while, it’s often the smarter (and cheaper) move to start with the gaps.

- What’s the biggest factor that drives up the cost?

Scope and complexity. If you’re dealing with multiple frameworks, outdated systems, or poor documentation, the analysis takes more time. It’s not always the number of people in the company that matters most – it’s how messy or unclear things are behind the scenes.

- Can we do a gap analysis ourselves to save money?

Yes, in theory. But unless you have experienced compliance professionals in-house, the risk is missing something critical or underestimating how deep the gaps go. Many teams try a DIY approach first, then bring in outside help when things get overwhelming or unclear. That’s not wrong, just budget time and resources accordingly.

- How often should we run a compliance gap analysis?

At a minimum, once every 1 to 2 years, or whenever there’s a big change in your environment, like adopting a new system, expanding into a new market, or targeting new compliance standards. If you’re in a heavily regulated industry, you’ll probably need smaller reviews more frequently to stay on track.

- Do compliance gap analysis reports include solutions or just problems?

Good ones include both. The best reports not only list what’s out of alignment but also offer practical steps to fix it, often broken down by risk or urgency. If all you’re getting is a red-yellow-green dashboard without context or next steps, that’s a red flag.

- What’s the link between gap analysis and remediation cost?

The gap analysis sets the stage. It doesn’t just highlight what’s missing – it gives you the roadmap to fix it. In fact, the cost of remediation often ends up being 3 to 5 times the cost of the gap analysis itself, depending on how serious the issues are. That’s why budgeting for both together makes more sense than treating them as separate efforts.