פיתוח אפליקציית העברת כספים כרוך בתכנון קפדני, בתכונות חיוניות ובדגש חזק על אבטחה. במדריך זה, נלווה אתכם בתהליך יצירת אפליקציה מוצלחת העונה על צרכי המשתמשים ועל תקני התעשייה. בין אם אתם פונים למשתמשים פרטיים או לעסקים, סקירה מקיפה זו תסייע לכם להתחיל במסע פיתוח האפליקציה שלכם.

למה ליצור אפליקציית העברת כספים?

לפני שנצלול לתהליך הפיתוח, חשוב להבין את הגורמים המניעים את הצמיחה של אפליקציות העברת כספים. שוק העברת הכספים העולמי מתרחב במהירות, עם למעלה מ-281 מיליון מהגרים בינלאומיים, שרבים מהם מסתמכים על פלטפורמות דיגיטליות כדי לשלוח כסף הביתה. מגמה זו באה לידי ביטוי בצמיחה המהירה של פתרונות תשלום דיגיטליים, שצפויים להגיע ל-$9.87 טריליון דולר עד 2030.

הגורמים העיקריים המניעים את הביקוש לאפליקציות להעברת כספים:

- אימוץ טלפונים חכמים: חדירת הסמארטפונים הגוברת הופכת את התשלומים וההעברות הסלולריות לנגישים יותר למשתמשים.

- עסקאות חוצות גבולות: מהגרים ועובדים בינלאומיים מניעים את הביקוש לפתרונות העברת כספים מהירים וחסכוניים.

- הצורך בביטחון ובנוחות: העברות כספים דיגיטליות הן בטוחות יותר ופחות מסורבלות בהשוואה לשיטות הבנקאיות המסורתיות.

- הכללה פיננסית: אנשים באזורים מוחלשים או ללא גישה לשירותי בנקאות מסורתיים יכולים להשתמש באפליקציות אלה כדי לשלוח ולקבל כסף.

בהתחשב בגורמים אלה, זהו הזמן האידיאלי לפיתוח אפליקציית העברת כספים שתענה על צרכים אלה ותבלוט בשוק התחרותי.

תכונות חיוניות של אפליקציית העברת כספים

כדי להצליח בשוק הפינטק התחרותי, האפליקציה שלך צריכה להציע תכונות חיוניות המעניקות עדיפות לקלות השימוש, לאבטחה ולפונקציונליות. תכונות אלה יהפכו את האפליקציה לבעלת ערך ואמינה עבור המשתמשים:

- התראות על עסקאות בזמן אמת. תכונה מרכזית בכל אפליקציית העברת כספים היא התראות בזמן אמת. התראות אלה מודיעות למשתמשים על פעולות העברה, ומספקות שקיפות ואבטחה.

- תמיכה במטבעות מרובים. בעולם גלובלי, תמיכה במטבעות מרובים היא חיונית להעברות כספים בינלאומיות. האפליקציה שלך צריכה לאפשר למשתמשים לשלוח כספים מעבר לגבולות במטבעות מרובים, עם שערי חליפין תחרותיים.

- אמצעי אבטחה חזקים. אבטחה היא גורם מכריע בכל אפליקציה פיננסית. כדי להגן על המידע הרגיש והנתונים הפיננסיים של המשתמשים, האפליקציה חייבת לשלב תכונות אבטחה חזקות כגון הצפנת נתונים, 2FA ו-SSL.

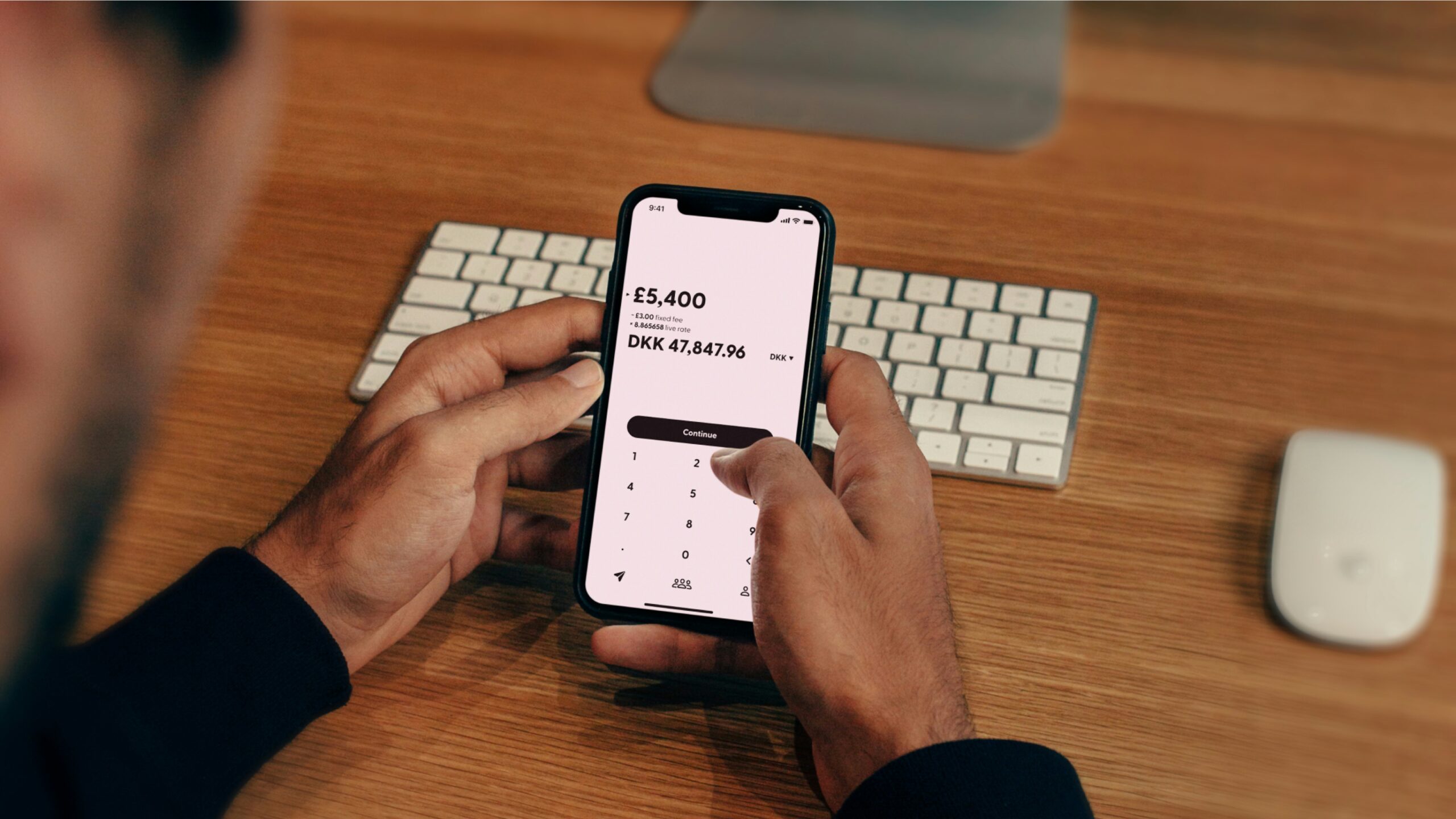

- ממשק ידידותי למשתמש. ממשק משתמש (UI) נקי, פשוט ואינטואיטיבי יבטיח שמשתמשים בכל רמות הידע הטכני יוכלו לנווט באפליקציה בקלות. קחו בחשבון את עקרונות עיצוב חוויית המשתמש (UX) כדי להפוך את תהליך העברת הכסף לקל ככל האפשר.

- עמידה בתקנים רגולטוריים. תקנות פיננסיות כגון AML (מניעת הלבנת הון), KYC (הכר את הלקוח שלך) ו-PCI DSS הן קריטיות בענף העברת הכספים.

- תשלומים והעברות בתוך האפליקציה. אפשר למשתמשים לשלוח כסף באמצעות שיטות תשלום שונות, כגון העברות בנקאיות, העברות מכרטיס לכרטיס והעברות P2P.

- היסטוריית עסקאות ודיווח. מתן היסטוריית עסקאות מפורטת למשתמשים הוא חיוני לשקיפות. זה יכול גם לעזור בפתרון מחלוקות או טעויות בהעברות.

שילוב תכונות אלה יבטיח שהאפליקציה להעברת כספים שלך תבלוט בשוק, ותציע פתרון מאובטח, קל לשימוש ותואם לדרישות הרגולטוריות לצרכים הפיננסיים של המשתמשים.

5 אפליקציות פופולריות להעברת כספים שיעוררו בך השראה לפיתוח

בעת פיתוח אפליקציית העברת כספים, כדאי לבחון אפליקציות מצליחות בשוק כדי להבין מה עובד ומהן התכונות החשובות ביותר למשתמשים. להלן חמש אפליקציות פופולריות להעברת כספים שזכו להצלחה נרחבת, וכל אחת מהן מציעה תכונות ושירותים ייחודיים שמהם תוכלו לשאוב השראה.

1. PayPal

PayPal היא אפליקציית העברת כספים מובילה בעולם, המאפשרת למשתמשים לשלוח כסף בתוך המדינה ומחוצה לה, לשלם עבור מוצרים ושירותים, לנהל עסקאות עסקיות ולהשתמש בתכונות כגון PayPal Credit.

2. אפליקציית Cash

Cash App הוא שירות תשלומים סלולרי פופולרי המאפשר למשתמשים לשלוח ולקבל כסף במהירות. הוא זכה לפופולריות רבה בארצות הברית בזכות הפשטות שלו ותכונותיו הייחודיות.

3. חכם

Wise הוא שירות העברת כספים בינלאומי המציע העברות בינלאומיות מהירות ומשתלמות עם עמלות שקופות. Wise ידוע בשערי החליפין הטובים ביותר ובעמלות ההעברה הנמוכות שלו, מה שהופך אותו למועדף עבור העברות כספים בינלאומיות.

4. ווסטרן יוניון

Western Union הוא אחד משירותי העברת הכספים הוותיקים והמבוססים ביותר בעולם. עם אפשרויות מקוונות ופרונטליות, הוא מאפשר לאנשים לשלוח כסף הן בתוך המדינה והן לחו"ל.

5. Revolut

Revolut היא אפליקציית בנקאות דיגיטלית המספקת למשתמשים שירותים פיננסיים כגון העברת כספים, ניהול הוצאות ומסחר במטבעות קריפטוגרפיים. היא פופולרית בזכות התכונות החדשניות שלה ומחיריה התחרותיים.

הסתכלות על אפליקציות העברת הכספים המצליחות הללו יכולה לספק לך תובנות חשובות לגבי התכונות והשירותים שהמשתמשים מעריכים ביותר.

מדריך צעד אחר צעד לבניית אפליקציית העברת כספים

יצירת אפליקציית העברת כספים היא תהליך מורכב אך מתגמל. בצע את השלבים הבאים כדי להבטיח שהאפליקציה שלך תפותח כך שתענה על ציפיות המשתמשים, תספק עסקאות חלקות ותעמוד בדרישות החוק.

שלב 1: ניתוח צרכי העסק וגיבוש הדרישות

התחל בהבנה ברורה של יעדי העסק שלך ושל שוק היעד. זה כרוך במחקר:

- קהל היעד: האם אתה מתמקד באנשים פרטיים, בעסקים, או בשניהם?

- תכונות עיקריות: אילו תכונות ישרתו בצורה הטובה ביותר את המשתמשים שלך (העברות P2P, תשלומים, וכו')?

- ניתוח תחרותי: מה מציעים המתחרים שלך, ובמה האפליקציה שלך יכולה להתבלט?

צעדים אלה מבטיחים שהאפליקציה שתיצרו תתאים הן לציפיות המשתמשים והן להזדמנויות בשוק, ותכין את הקרקע לתהליך פיתוח מוצלח.

שלב 2: צור תוכנית פרויקט מפורטת

יצירת תוכנית פרויקט מפורטת היא אחד השלבים החשובים ביותר בבניית אפליקציית העברת כספים. היא מהווה את הבסיס לכל תהליך הפיתוח, ומספקת כיוון ברור, אחריות ומבנה. תוכנית מובנית היטב לא רק מסייעת במעקב אחר ההתקדמות, אלא גם מאפשרת להקצות משאבים ביעילות, לנהל סיכונים ולהבטיח שהפרויקט יישאר במסגרת התקציב ובלוח הזמנים.

להלן המרכיבים החיוניים שתוכנית הפרויקט שלך צריכה לכלול כדי למקסם את ההצלחה:

- לוח זמנים לפיתוח: לוח זמנים ברור ומציאותי הוא חיוני לניהול הפרויקט כולו מתחילתו ועד סופו. חלקו את הפיתוח לשלבים כגון מחקר, תכנון, פיתוח, בדיקה ופריסה.

- אומדן תקציב: תקציב מפורט היטב הוא חיוני כדי להבטיח שהפרויקט יישאר בר-קיימא מבחינה כלכלית לאורך כל מחזור חייו. התקציב צריך לכסות לא רק את שלב הפיתוח, אלא גם את השיווק, התחזוקה השוטפת וההרחבה.

- תפקידים בצוות: הגדרה ברורה של תפקידי הצוות מבטיחה שכל אחד מחברי הצוות יכיר את תחומי האחריות שלו ויתרום באופן יעיל להצלחת הפרויקט.

תוכנית פרויקט מפורטת לא רק מסייעת לשמור על סדר בצוות, אלא גם מספקת נראות ברורה של לוח הזמנים, התקציב והתפקידים לאורך כל תהליך הפיתוח. היא מאפשרת לכם לנהל ציפיות, למנוע עיכובים מיותרים ולהבטיח שהפרויקט יושלם בהצלחה.

שלב 3: עיצוב ממשק המשתמש/חוויית המשתמש של האפליקציה

חוויית המשתמש (UX) ועיצוב ממשק המשתמש (UI) הם גורמים מכריעים בהצלחתה של כל אפליקציית העברת כספים. העיצוב צריך להיות אינטואיטיבי, קל לניווט ומושך מבחינה ויזואלית. עיצוב חלק ומושך יכול לשפר משמעותית את שימור המשתמשים, להפחית את הנטישה ולהגביר את המעורבות.

הנה מה שיש לקחת בחשבון:

- עיצוב פריסה: התחל ביצירת פריסה ברורה וקלה לניווט, המאפשרת למשתמשים לבצע עסקאות במהירות ובקלות. תן עדיפות לזרימה פשוטה והגיונית, עם גישה קלה לכל התכונות החיוניות.

- קריאות לפעולה (CTA): עיצוב כפתורים ברורים ומכווני פעולה המנחים את המשתמשים בין תכונות האפליקציה. כפתורים אלה צריכים לבלוט מבחינה ויזואלית ולהיות ממוקמים במקומות הגיוניים במסלול המשתמש .

- אב טיפוס: בנה אב טיפוס כדי לבדוק את ממשק האפליקציה לפני פיתוח בקנה מידה מלא. אב טיפוס מאפשר לך לאסוף משוב מוקדם ולזהות בעיות בשימושיות לפני שתשקיע משאבים משמעותיים בקוד.

- משוב משתמשים: לשלב משוב ממשתמשים פוטנציאליים בשלב התכנון. ניתן לעשות זאת באמצעות סקרים, קבוצות מיקוד או בדיקות בטא.

- אטרקטיביות ויזואלית: השתמשו בצבעים, טיפוגרפיה ואייקונים מושכים המשפרים את חוויית המשתמש. ממשק מעוצב היטב ומלוטש מעודד אמון וגורם למשתמשים להרגיש בטוחים באמינות האפליקציה.

על ידי התמקדות באלמנטים עיצוביים אלה, אתם מבטיחים למשתמשים חוויה חלקה ומהנה, שהיא קריטית לטיפוח מעורבות ושימוש ארוך טווח.

שלב 4: בחרו את מערך הטכנולוגיות

בחירת מערך הטכנולוגיות הנכון היא קריטית להצלחת אפליקציית העברת הכספים שלכם. היא קובעת את אופן פעולת האפליקציה, את אופן האינטראקציה של המשתמשים איתה ואת רמת האבטחה שבה תטופלו העסקאות.

סט טכנולוגיות שנבחר בקפידה מבטיח פעולה חלקה, יעילה ובטוחה של האפליקציה, מאפשר לה להתרחב לפי הצורך ומספק חוויה אמינה למשתמשים:

- חזית: עבור אפליקציות אינטרנט, הטכנולוגיות כוללות HTML למבנה, CSS לעיצוב ומסגרות JavaScript כמו React או Angular. עבור אפליקציות מובייל, נעשה שימוש ב-Swift (iOS), Kotlin (Android) או מסגרות חוצות פלטפורמות כמו React Native או Flutter.

- בק-אנד: הטכנולוגיות העיקריות כוללות את Python, הידועה בפשטותה ובעוצמתה בלוגיקה אחורית ועיבוד נתונים, ואת Java, המציעה אבטחה גבוהה ומדרגיות ליישומים ברמה ארגונית הדורשים מערכות אחוריות חזקות.

- פיתוח מובייל: Swift היא השפה העיקרית לפיתוח אפליקציות iOS, המספקת ביצועים גבוהים ואמינות. Kotlin היא השפה המועדפת לפיתוח Android, ומציעה שילוב חלק עם Android Studio.

בחירת מערך הטכנולוגי הנכון מבטיחה שהאפליקציה תפעל היטב, תישאר מאובטחת ותתאים את עצמה ביעילות ככל שמאגר המשתמשים שלך יגדל ונפח העסקאות יגדל.

שלב 5: פיתוח ובדיקת האפליקציה

בשלב זה מתבצעים הקוד והטמעת התכונות בפועל. חשוב מאוד לגשת לתהליך הפיתוח בגמישות ובגישה איטרטיבית כדי להבטיח שהמוצר הסופי יעמוד בציפיות המשתמשים ויהיה נקי מבאגים ומפרצות אבטחה:

- פיתוח זריז: אימוץ גישת פיתוח זריזה מאפשר גמישות ואיטרציות מהירות. שיטה זו כרוכה בעבודה במחזורים קצרים (ספרינטים) שבהם מפתחים ובודקים חלקים קטנים של האפליקציה לפני המעבר לשלב הבא.

- בדיקות אבטחה: בהתחשב בכך שאפליקציות להעברת כספים מטפלות בנתונים פיננסיים רגישים, האבטחה היא בעלת חשיבות עליונה. בצעו בדיקות חדירה והערכות פגיעות כדי לזהות סיכוני אבטחה פוטנציאליים, כגון הפרות נתונים, גישה לא מורשית והונאות בעסקאות.

- בדיקות שמישות: כדי להבטיח שהאפליקציה עונה על צרכי המשתמשים, בצעו בדיקות שימושיות על ידי כך שתנו למשתמשים אמיתיים להתנסות באפליקציה. אספו משוב על חוויית השימוש שלהם כדי לזהות תחומים שניתן לשפר, בין אם הם קשורים לפונקציונליות, לניווט או לשימושיות הכללית.

- בדיקות ביצועים: בדקו את האפליקציה בתנאים שונים, כגון תעבורה גבוהה ועסקאות מרובות בו-זמנית, כדי להבטיח שהיא פועלת היטב תחת עומס. כך תוכלו לזהות צווארי בקבוק פוטנציאליים העלולים להשפיע על חוויית המשתמש, במיוחד בתקופות של תעבורה גבוהה.

פיתוח ובדיקות יסודיים מבטיחים שהאפליקציה שלך תפעל כראוי, תהיה מאובטחת ותספק חווית משתמש מצוינת. שלב בדיקות יסודי יסייע במניעת בעיות לפני ההשקה, ויחסוך זמן ומשאבים.

שלב 6: שילוב מערכות תשלום ו-API

כדי להקל על ביצוע עסקאות חלקות ולשפר את הפונקציונליות של אפליקציית העברת הכספים שלכם, יש חשיבות רבה לשילוב מערכות תשלום וממשקי API של צד שלישי. שילובים אלה מאפשרים לאפליקציה לעבד תשלומים, לטפל בהמרת מטבעות ולהציע תכונות נוספות כגון זיהוי הונאות:

- שילוב שערי תשלום: בחרו בשערי תשלום מאובטחים ואמינים כגון Stripe או PayPal לטיפול בעסקאות. שערים אלה מספקים את התשתית הדרושה לעיבוד תשלומים בצורה בטוחה, ותומכים בשיטות תשלום שונות כגון כרטיסי חיוב/אשראי וארנקים דיגיטליים.

- שילוב ממשקי API בנקאיים: כדי להבטיח שהאפליקציה תוכל לעבד העברות בין בנקים ומוסדות פיננסיים שונים, יש לשלב ממשקי API של בנקאות פתוחה. כך יוכלו המשתמשים לשלוח כסף ישירות אל חשבונות הבנק שלהם ומחשבונותיהם בצורה חלקה ובטוחה.

- ממשקי API להמרת מטבעות: עבור משתמשים המבצעים העברות בינלאומיות, שלבו ממשקי API להמרת מטבעות כגון Open Exchange Rates. ממשקי API אלה מספקים שערי חליפין בזמן אמת, ומבטיחים שהמשתמשים שלכם יקבלו שערים מדויקים ותחרותיים בעת המרת מטבעות לעסקאות בינלאומיות.

- ממשקי API לזיהוי הונאות: כדי למנוע עסקאות הונאה, שקול לשלב מערכות לזיהוי הונאות. ממשקי API אלה מנתחים דפוסי עסקאות ומסמנים פעילויות חשודות, ובכך מסייעים להגן הן על המשתמשים והן על הפלטפורמה שלך מפני הונאות.

אינטגרציות אלה חיוניות לייעול העסקאות, לשיפור חוויית המשתמש ולהבטחת תפקוד יעיל ובטוח של האפליקציה במערכת הפיננסית הדיגיטלית.

שלב 7: פריסת האפליקציה

לאחר שהאפליקציה עברה בדיקות מקיפות והיא מוכנה לשחרור, השלב הבא הוא הפריסה. שלב זה כולל הכנת האפליקציה להשקה, הגשתה לחנויות האפליקציות ווידוא שתשתית האפליקציה מסוגלת להתמודד עם תעבורת המשתמשים בזמן אמת.

- הכנות לקראת ההשקה: לפני שתגיש את האפליקציה לחנויות האפליקציות, ודא שכל המסמכים הדרושים, כולל תיאורי האפליקציה, צילומי מסך ותנאי השירות, מוכנים.

- הגשת בקשה לחנות האפליקציות: שלח את האפליקציה לחנויות האפליקציות הרלוונטיות, כולל Google Play Store עבור Android ו-Apple App Store עבור iOS.

- אסטרטגיה שיווקית: לפתח אסטרטגיה שיווקית לקידום השקת האפליקציה. זו יכולה לכלול קמפיינים שיווקיים דיגיטליים, קידום ברשתות החברתיות, שיתופי פעולה עם משפיענים והודעות לעיתונות.

פריסה מוצלחת דורשת תכנון קפדני כדי להבטיח שהאפליקציה תהיה נגישה למשתמשים, תפעל כמצופה ותגיע לקהל רחב.

שלב 8: תמיכה ועדכונים לאחר ההשקה

השקת אפליקציית העברת הכספים שלכם היא רק ההתחלה. תמיכה לאחר ההשקה ועדכונים שוטפים הם חיוניים לשמירה על תפקוד חלק של האפליקציה, לטיפול בבאגים ולמענה על צרכים משתנים של המשתמשים:

- לפקח על הביצועים: השתמש בכלי ניתוח כדי לעקוב אחר התנהגות המשתמשים, היקפי העסקאות וביצועי האפליקציה. נתונים אלה יסייעו בזיהוי תחומים הדורשים שיפור ובאופטימיזציה של מעורבות המשתמשים.

- עדכוני אבטחה: עדכן את האפליקציה באופן קבוע כדי לתקן פרצות אבטחה ולהבטיח שהיא תמשיך לעמוד בתקנות המשתנות. שמירה על אבטחת האפליקציה היא חיונית לשמירה על אמון המשתמשים ולמניעת דליפות נתונים.

- תיקוני באגים ושיפורים בתכונות: לאחר ההשקה, עקבו באופן פעיל אחר באגים וטפלו מיד בכל בעיה. הקשיבו למשוב המשתמשים ויישמו תכונות חדשות או שפרו את הקיימות כדי לשפר את הפונקציונליות של האפליקציה ולענות על ציפיות המשתמשים.

על ידי מתן תמיכה ועדכונים שוטפים, תוכלו להבטיח שהאפליקציה שלכם תישאר רלוונטית, מאובטחת וידידותית למשתמש, מה שיעזור לכם לשמור על המשתמשים ולהגדיל את בסיס המשתמשים של האפליקציה.

כמה עולה לבנות אפליקציית העברת כספים?

עלות פיתוח אפליקציית העברת כספים יכולה לנוע בין $30,000 עבור MVP בסיסי ליותר מ-$1 מיליון עבור פתרון ברמה ארגונית עם כל התכונות, כולל עיבוד עסקאות מותאם אישית ואבטחה מתקדמת.

גורמים המשפיעים על העלות:

- תכונות. הוספת פונקציונליות כגון תמיכה במטבעות מרובים, התראות בזמן אמת ואמצעי אבטחה מתקדמים תעלה את המחיר.

- פלטפורמה. פיתוח האפליקציה הן ל-iOS והן ל-Android מעלה את העלות בשל הצורך בקידוד נפרד או בשימוש במבני תשתית חוצה פלטפורמות.

- סט טכנולוגי. שימוש בטכנולוגיות אחוריות מיוחדות או שילוב ממשקי API מורכבים ידרשו זמן פיתוח רב יותר ומומחיות רבה יותר.

- צוות פיתוח. העסקת מפתחים, מעצבים ומומחים מנוסים עלולה להעלות את המחיר הכולל.

העלות הכוללת של פיתוח אפליקציית העברת כספים מושפעת מגורמים כגון תכונות, בחירת פלטפורמה, מערך טכנולוגי ומומחיות צוות הפיתוח. הבנת גורמים אלה יכולה לסייע לכם לנהל את העלויות ולהתאים את האפליקציה לצרכים הספציפיים שלכם.

A-Listware: השותף המהימן שלך בבניית אפליקציית העברת כספים

ב רשימת מוצרים א', אנו מתמחים במתן שירותי פיתוח תוכנה וייעוץ IT מהשורה הראשונה, מה שהופך אותנו לשותף האידיאלי עבור עסקים המעוניינים ליצור אפליקציית העברת כספים אמינה ובטוחה. עם ניסיון בענף, צוות המומחים שלנו מספק פתרונות המניעים צמיחה, משפרים את האבטחה ומבטיחים יעילות תפעולית. אנו מאגדים מגוון מקיף של שירותים, מומחיות ושיטות עבודה גמישות כדי לעזור לכם לפתח אפליקציה מותאמת אישית לצרכים העסקיים הייחודיים שלכם.

הצוות שלנו מבין את המורכבות הכרוכה ביצירת אפליקציית העברת כספים, החל מהבטחת אמצעי אבטחה חזקים ועד עמידה בתקנות בינלאומיות. אנו גאים בגישה הגמישה והמכוונת לתוצאות שלנו, המאפשרת לנו להתמודד עם אתגרים באופן ישיר תוך שמירה על התמקדות חזקה ביעדים שלכם. ב-A-listware, אנו מאמינים במתן פתרונות העולים על הציפיות ומניעים הצלחה מתמשכת בתחום הטכנולוגיה הפיננסית.

נקודות עיקריות:

- ניסיון מוכח ביצירת אפליקציות מאובטחות וידידותיות למשתמש עבור המגזר הפיננסי

- שירותים מותאמים אישית ליחידים או לעסקים, מתשלומים בינלאומיים ועד העברות קריפטוגרפיות

- פתרונות מהירים, גמישים וניתנים להרחבה העונים על דרישות פרויקטים דינמיות

- תמיכה מלאה, החל מאסטרטגיה ועיצוב ועד פריסה ותמיכה לאחר ההשקה

- מתמקדת בהגנה על נתונים ובעמידה בתקנים רגולטוריים כדי להבטיח חווית משתמש בטוחה

שירותים:

- בניית מערכות אחוריות, מסדי נתונים ואינטגרציות מאובטחות

- עיצוב ממשקים אינטואיטיביים ומרתקים

- יצירת אפליקציות iOS ו-Android עם תכונות תשלום חלקות

- ייעוץ מומחה בנושאי ארכיטקטורת אפליקציות, אבטחה ותאימות

- יישום הצפנה, שערי תשלום מאובטחים ומניעת הונאות

- שימוש בניתוח נתונים כדי לייעל את חוויית המשתמש והחלטות עסקיות

מַסְקָנָה

יצירת אפליקציית העברת כספים היא מיזם מרגש ומתגמל, העונה על צורך עולמי הולך וגדל בביצוע עסקאות פיננסיות מאובטחות, מהירות ונוחות. על ידי התמקדות בתכונות חיוניות כגון עיצוב ידידותי למשתמש, תמיכה במטבעות מרובים, אמצעי אבטחה חזקים ותאימות לתקנות הרלוונטיות, תוכלו לבנות אפליקציה העונה הן על ציפיות המשתמשים והן על תקני התעשייה. ממחקר שוק מעמיק ועד תמיכה מתמשכת לאחר ההשקה, כל שלב בתהליך הפיתוח ממלא תפקיד מכריע בהצלחת האפליקציה שלכם.

עם התפתחותו המתמשכת של עולם הפיננסים הדיגיטלי, קיימות הזדמנויות רבות לחדשנות. באמצעות תכנון קפדני של תכונות האפליקציה והתמקדות באבטחה ובשימושיות, תוכלו ליצור לעצמכם נישה בשוק העברות הכספים התחרותי. הגישה הנכונה, בתמיכת צוות פיתוח מתאים, תבטיח שהאפליקציה שלכם תספק ערך למשתמשים, תטפח אמון ותבלוט בשוק הצומח ללא הרף.

שאלות נפוצות

1. מדוע מחקר שוק הוא חיוני בעת פיתוח אפליקציית העברת כספים?

מחקר שוק עוזר לכם להבין את קהל היעד שלכם, את צרכיו והעדפותיו, ומבטיח שהאפליקציה שלכם תציע את התכונות והפונקציות הנכונות. הוא גם עוזר לזהות פערים בשוק שהאפליקציה שלכם יכולה למלא, מה שהופך אותה לתחרותית יותר.

2. מהן אמצעי האבטחה החיוניים לאפליקציית העברת כספים?

אבטחה היא גורם מכריע באפליקציות להעברת כספים. אמצעים חיוניים כוללים הצפנת נתונים, אימות דו-שלבי, שכבות שקע מאובטח (SSL) וזיהוי הונאות באמצעות בינה מלאכותית. תכונות אלה מגנות על נתוני המשתמשים ומונעות עסקאות לא מורשות, ובכך בונות אמון ומבטיחות בטיחות.

3. כיצד אוכל לוודא שאפליקציית העברת הכספים שלי תואמת לתקנות?

עמידה בתקנות כגון AML (מניעת הלבנת הון), KYC (הכר את הלקוח שלך), PCI DSS ו-GDPR היא קריטית. עליך להתייעץ עם מומחים משפטיים כדי להבטיח שהאפליקציה שלך עומדת בתקנים אלה, ליישם תהליכי אימות נאותים ולעדכן את האפליקציה באופן קבוע כדי להישאר תואמת לחוקים המשתנים.

4. כמה זמן לוקח לבנות אפליקציית העברת כספים?

הזמן הדרוש לבניית אפליקציית העברת כספים תלוי במורכבות התכונות ובגודל צוות הפיתוח. בממוצע, בניית מוצר מינימלי בר-קיימא (MVP) לאפליקציית העברת כספים אורכת 3-6 חודשים, בעוד שאפליקציה תפקודית מלאה עשויה לדרוש 6-12 חודשים, בהתאם למורכבות, לגודל הצוות ולתכונות.

5. מהן כמה מהתכונות העיקריות שהמשתמשים מצפים למצוא באפליקציית העברת כספים?

המשתמשים מצפים לתכונות כמו התראות על עסקאות בזמן אמת, תמיכה במטבעות מרובים, ניהול חשבון קל, עסקאות מאובטחות וממשק ידידותי למשתמש. הצעת תכונות אלה מבטיחה חוויה חלקה העונה על ציפיותיהם.